Paystack, a new electronic payment startup on a mission to deliver a safe and convenient payment experience to customers and merchants in Nigeria, has today launched its public beta.

The company which was founded in 2015 by the tech duo Olusola Akinlade (@shollsman) and Ezra Olubi (@0x) aim to provide Nigerian merchants with the tools and services needed to accept online payments from local and international customers using MasterCard, Visa and Verve Cards.

While some might argue that the last thing needed by startups and other small businesses in Nigeria is another online payment service since there are already several players in the market such as Interswitch, SimplePay, Voguepay, cashEnvoy, GTPay and others. Paystack works differently as it helps merchants to take payments securely on their website without the need to redirect to the payment gateway; this significantly improves the user experience and would help e-tailers easily cross sell.

Furthermore, paystack enables recurring payments to be accepted by merchants; thus solving a problem that many e-payment systems in Nigeria have not been able to solve and this is good for merchants such as hosting companies, recharge card sites, churches and businesses that generally run on the subscription business model. To make these happen they have partnered with Access Bank (the third Largest Bank in Nigeria) and have built a PCI Compliant payments infrastructure and API.

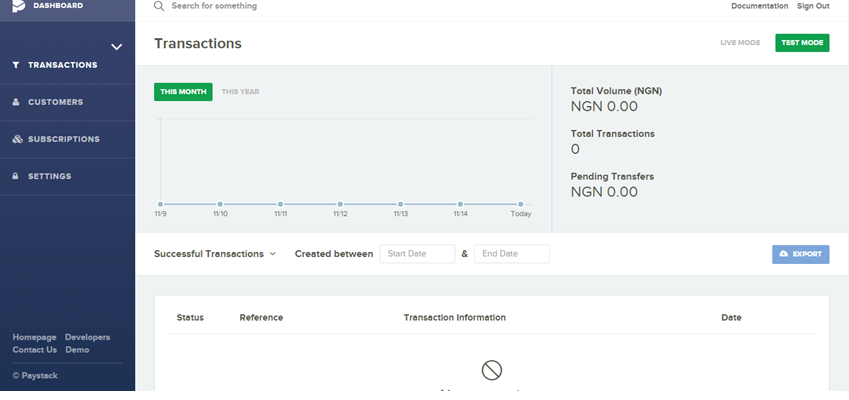

It is free to signup and early adopters on the service include Ginerbox, Jekalo, DIYLaw and PushCV. A quick signup showed a system with good UI design and a live test account activated immediately.

StartupLagos has been able to secure an interview with the founders and would update our readers on the plans this startup has for the Nigerian e-commerce and payment industry.