Nigerian Micro-lending startup Fairmoney has raised $42 million Series B to expand and diversify offerings for its users and expand to become the preferred financial destination for its users in Nigeria and India.

Tiger Global Management led the round. Existing investors from the company’s previous rounds, DST Partners, Flourish Ventures, Newfund, and Speedinvest also participated.

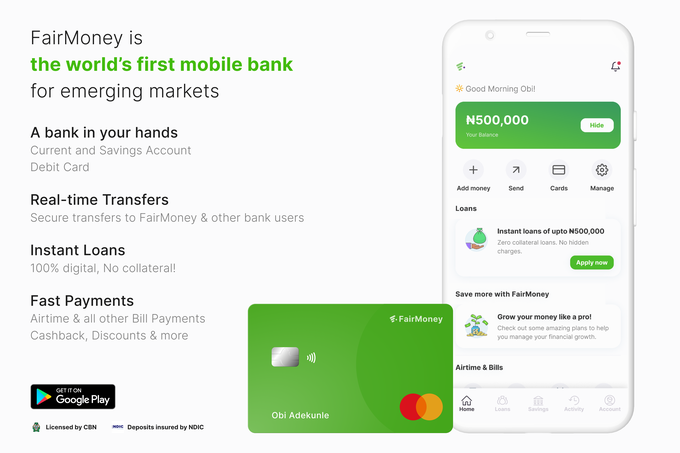

Founded in 2017 by Laurin Hainy, Matthieu Gendreau, and Nicolas Berthozat, FairMoney started as an online lender that provides collateral-free instant loans and bill payments to customers in Nigeria.

Providing access to Instant loans

Since its launch, the company has grown its user base to about 3.5 million registered users which includes 1.3 million unique bank account holders.

Last year, Fairmoney reported that it disbursed a total loan volume of $93 million to over 1.3 million users who made more than 6.5 million loan applications.

This year the company is looking to disburse $300 million worth of loans.

In 2020, the company expanded into India and has processed more than 500,000 loan applications from over 100,000 unique users in its 6 months of operation in the country, according to its CEO Laurin Hainy.

Evolution Into a Neo-bank

Hainy reveals Fairmoney has secured a Microfinance bank (MfB) licence from the Central Bank of Nigeria (CBN) which allows it to operate as a financial service provider in Nigeria.

“We have received our MFB banking license which now enables us to open current accounts for our users, and we’re doing that on quite a big scale,” Hainy said to TechCrunch. “We opened accounts for our repeated and new customers, which I think is quite a unique company strategy because we don’t need to burn millions of dollars of customer acquisition cost on users like other competitors. I think all of that has enabled us to become sort of the largest digital bank in Nigeria.”

However that is not all, Hainy disclosed other plans in place to give customers the “full digital banking experience”, “The ambition is that by the end of the year, the customer has the full-fledged banking experience from P2P transfers and lending to debit cards and current accounts. In addition to that, we are working on a number of additional services from savings products, stock trading, and crypto-trading products potentially depending on where regulation is heading,” He revealed.

And to achieve its goal to become a financial hub for its customers’ banking needs, the CEO said the company is embarking on a hiring spree for top talent. “We are hiring worldwide, and there are 150 open positions out there right now that we’re trying to fill with strong talent to help us build the financial app for Nigerians.”

The company has revealed that it will start servicing loans to registered SMEs in Nigeria.

Tiger Global invests in 2 African startups in a year

Months after participating in Flutterwave’s Series C in March, driving the Fintech giant to the unicorn status. Global-leading Investment firm, Tiger Global Management is backing another African startup.

This is is the first time the Global Hedge fund is investing in 2 African companies in a year, per public knowledge.

“We are excited to partner with FairMoney as they build a better financial hub for customers in Nigeria and India,” Scott Shleifer, partner at Tiger Global, said in a statement. “We were impressed by the team and the strong growth to date and look forward to supporting FairMoney as they continue to scale.”

Hainy affirms that Tiger Global’s track record makes this investment a great signal for the African market per Techcrunch

“I think what most people have been discussing is the question of sustainability. How long can digital banks operate as financial service providers while making losses? So I think that’s another great signal for the market that we’ve actually managed to do that in a profitable manner, providing upside for our shareholders and also showing our clients that they can actually bank on us in the future,” Hainy said.