Growing a business is very difficult, but once in a while we encounter a bit of luck and have an opportunity to grow. But then, the best direction becomes elusive.

March 1998: I was 12 and was stationed at one of the two provision retail stores owned by my mum. Business had been great and there was significant cash lying around. We were now presented with a choice, should we re-invest the cash into upgrading the 2 stores, or open a third store at the other end of town, or start a new business totally?

Before I get into this somewhat lengthy discussion, I will like to clarify that “diversification” is not something you do when the business is broke. If your business is in a bad shape and you are looking for some other business to engage in, then what you are doing isn’t “diversifying”, but instead “exiting” (whether intentionally or not). If this new business is related to the current one, then you are essentially “pivoting”.

The exciting part about running a business is the ups ‘n’ downs; there are periods when the world seems like great place and there are times when you just want to hide in a hole; everyone experiences them. When a business experiences long periods of boom (i.e. the business is now relatively successful), the end result is usually excess cash and every business owner then has to make a choice; Do I upgrade/expand on current resources/assets? Do I start an aggressive market campaign? Do I spin-off a related product or service? Do I take advantage of a new opportunity and start-up another venture? Ultimately, the question you are inherently asking is; how best do I invest this extra cash that will provide me with maximum returns, at an acceptable risk.

In my interaction with other business owners, I realised this decision is usually guided by “intuition-twisted logic” and sometimes, the person’s personality (pragmatic ones usually tilted towards expanding on current assets, while adventurous ones tilted towards exploring new markets). But why rely on intuition/guts when there is a methodology for making exactly this type of decision.

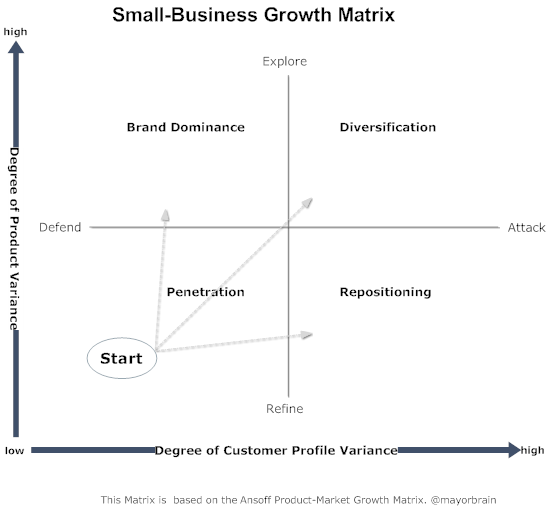

While this matrix is based on the Ansoff Product-Market growth matrix, I have modified it a bit. Unlike the Ansoff Matrix which uses “New Market, Existing Market”, I have used “Degree of Customer Profile variance”; that is, how different is the customer group when you take into account all components of the customer profile (demographic, psychographic, buying pattern, etc.).

To understand the impact of this difference, consider a business that intends to launch its product in a nearby country; Ansoff calls this “Market Development” since the new country is essentially a new market. BUT, in this matrix, because the location is the only difference and they are essentially serving the same type of customer, we call this move “Penetration”. Now, if the culture in the new country is so much different from the base country, such that many other elements of the customer profile are affected, then this move is a “Repositioning”.

This matrix is simple and powerful because it reduces a very tough decision into 2 clear questions.

- Do you want to attack/attract a new type of consumer, or do you want to defend/nurture your existing consumers?

- Do you want to refine or leverage on existing products/services, or do you want to explore entirely new products/services?

If you are looking to establish your business amongst your current/similar customer group either by aggressive marketing efforts and/or introducing supporting products/services, then you are essentially trying to gain better penetration. This is the most low risk of all growth strategies. But while it is low risk, growth here is usually more incremental than exponential.

If you want to serve a similar set of customers but instead with totally unrelated products, then you are trying to reinforce your brand on your targeted customer group (For example, Selling Men’s Wear => Starting a Barbing Saloon OR Selling Records Management Software to Real Estate businesses => Starting a Marketing Agency for Real Estate businesses). Because you understand the customer, the risk here is moderate and can be well within your control if you have an excellent understanding of competitive forces in the new industry/product segment. Be careful though, you are at a great risk of “brand confusion”.

Going after a new type of customer brings with it promise of great rewards, but with at a higher risk. If you want to serve a new set of customers by modifying (or building upon) your existing products/services, then you are essentially repositioning. (Selling Men’s Wear => Selling Women’s Underwear OR Selling Records Management software to Real Estate businesses => Selling Document Management Software to Architectural Firms).

If you intend to serve this new type of customers with a product/service that is very much unrelated to your existing business, then you are essentially diversifying and making a high risk move (with very high rewards of course). This usually happens when business owners identify a very big opportunity or/and when there is a potential threat to the existing business and they want to “spread the risk”.

Each of this growth strategies do come with their challenges and as a business owner you will always be faced with tough choices, whichever path you take. But atleast, now you know what path you are on and where it should lead to, all things being equal.

In 1999, we aspired to be the dominant store in town so we decided to open a third provision store at the other side of town. Suffice to say, this didn’t end too well for us, back then I didn’t understand what went wrong, except that the third store was a resource drainer with significantly less turnover. Now, when I think back, I know exactly where it all went wrong, but that is a discussion for another day.

This post first appeared on Mayo Brain’s Blog